India’s UPI: Bridging Borders, Empowering Transactions.

India’s UPI goes global, fostering digital connectivity, promoting financial inclusion, and bolstering international cooperation.

Image Source: Forbes Magazine

The Indian digital payments market is expected to touch 411 billion transactions in FY27, from 103 billion in FY23, PwC said in a May 2023 report, with the industry expanding steadily in the last five years at a CAGR of 50 percent transaction, volume-wise and 60 percent transaction, value-wise respectively. The recent launch of India’s Unified Payments Interface (UPI) in Sri Lanka and Mauritius marks a significant milestone in extending the reach of digital financial services beyond national borders.

Breaking Boundaries:

February 12th marked a historic moment as India’s UPI, renowned for its efficiency and convenience, made its debut in Sri Lanka and Mauritius. This expansion underscores India’s commitment to promoting digital connectivity and facilitating seamless transactions on an international scale.

Enhancing Financial Inclusion:

The inclusion of RuPay card services in Mauritius further amplifies the scope of digital financial services, offering a convenient and secure payment solution to residents and visitors alike. With India’s deep-rooted cultural ties with Sri Lanka and Mauritius, this launch is poised to foster greater economic integration and cooperation between nations.

Facilitating Travel and Trade:

The extension of UPI settlement services to Sri Lanka and Mauritius not only benefits Indian nationals traveling abroad but also streamlines transactions for Sri Lankan and Mauritian nationals visiting India. This seamless flow of funds enhances the travel experience and fosters bilateral trade relations.

Strategic Initiatives:

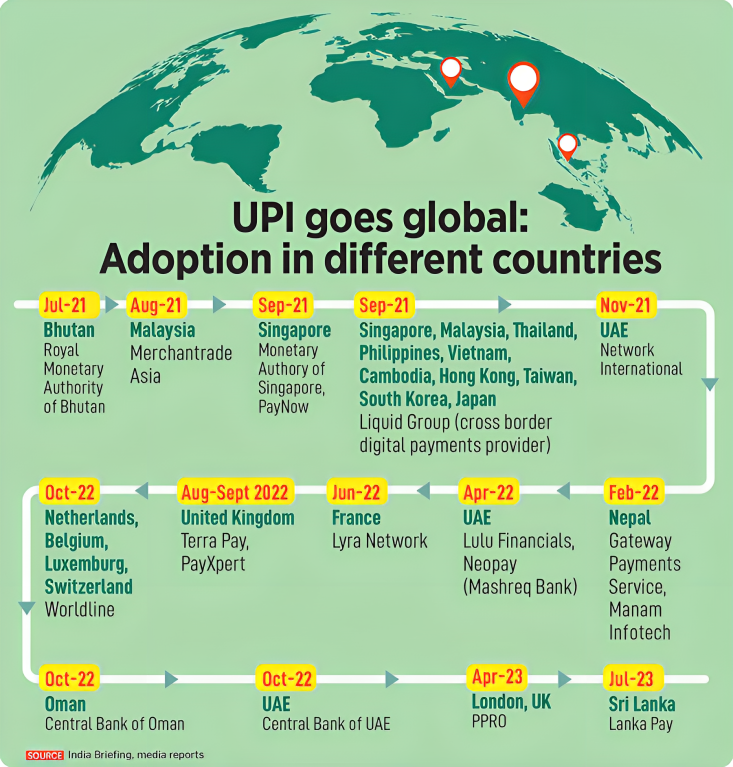

India’s proactive efforts to promote the use of the rupee and its payment systems globally reflect a strategic push towards financial integration and collaboration. Initiatives such as linking UPI with UAE’s Instant Payment Platform and ongoing discussions with countries across Southeast Asia, Europe, and Africa underscore India’s commitment to fostering cross-border digital connectivity and financial inclusion.

The Global Reach of UPI

Apart from Sri Lanka and Mauritius, India’s UPI has made inroads into several countries, facilitating convenient and secure payment transactions for travelers and businesses alike. Countries such as Bhutan, Oman, UAE, Southeast Asian nations, Nepal, and France have embraced UPI, signaling the growing acceptance of India’s digital payment ecosystem on the global stage.

UPI functionality overseas simplifies the payment process for users, who can register their bank accounts with a UPI-enabled mobile application. By scanning QR codes or using designated payment platforms, individuals can seamlessly transfer funds in their preferred currency, enhancing convenience and accessibility.

The global expansion of India’s digital payment infrastructure not only fosters financial inclusion but also strengthens bilateral ties and promotes economic cooperation on a global scale. As digital payment ecosystems continue to evolve and interconnect, initiatives like UPI pave the way for greater efficiency, convenience, and accessibility in international transactions.

Key Learnings

- India’s digital payments market is experiencing exponential growth, with transactions expected to reach 411 billion by FY27.

- The launch of UPI in Sri Lanka and Mauritius signifies India’s commitment to fostering digital connectivity and facilitating cross-border transactions.

- Initiatives such as the inclusion of RuPay card services and the establishment of UPI settlement services enhance the scope of digital financial services in international markets.

- India’s efforts to promote the use of the rupee and its payment systems globally reflect a strategic push towards financial integration and collaboration.

- The global expansion of UPI extends beyond Sri Lanka and Mauritius, encompassing countries across Southeast Asia, the Middle East, and Europe.

In summary, India’s digital payments revolution extends its reach beyond national borders, fostering financial inclusion, enhancing bilateral ties, and promoting economic cooperation on a global scale.

Team Profile

- News Writer

- Shubham Chakraborty, a Freelance Writer, holds an MBA from XLRI and boasts 6.5 years of extensive corporate experience. Departing from his corporate path, he embarked on a journey to fulfill his childhood dream of focusing on writing.

Latest entries

English12 May 2024US Likely to Impose 100% Tariff on Electric Vehicle Imports from China

English12 May 2024US Likely to Impose 100% Tariff on Electric Vehicle Imports from China English26 March 2024UN Security Council Demands Immediate Ceasefire for the First Time Amidst Ongoing Israel-Gaza Conflict

English26 March 2024UN Security Council Demands Immediate Ceasefire for the First Time Amidst Ongoing Israel-Gaza Conflict English23 March 2024Bloodbath in Moscow: ISIS-K Delivers Shocking Blow to Heart of Russia

English23 March 2024Bloodbath in Moscow: ISIS-K Delivers Shocking Blow to Heart of Russia English20 March 2024A Hollow Victory: Putin Claims Landslide in Russian Election and Scorns US Democracy

English20 March 2024A Hollow Victory: Putin Claims Landslide in Russian Election and Scorns US Democracy